Louisiana bank failure: Sign of looming capitalist crisis

May 01, 2017

On

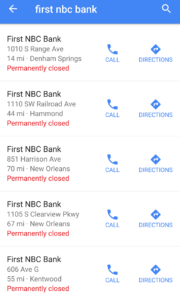

April 28, the New Orleans-based First NBC Bank topped the last three

bank failures this year with over $1 billion dollar in clean up costs.

The Louisiana Office of Financial Institutions turned the bank over to

the Federal Deposit Insurance Corporation this past Friday.

On

April 28, the New Orleans-based First NBC Bank topped the last three

bank failures this year with over $1 billion dollar in clean up costs.

The Louisiana Office of Financial Institutions turned the bank over to

the Federal Deposit Insurance Corporation this past Friday.The peak of the Great Recession witnessed 157 bank closures–more than the 140 closures the year before. This was also the most since the savings and loan crisis two decades earlier.

This current closure forecasts more bank failures as well as exposing the fairytale notion that was touted as the mission of First NBC Bank when it opened in 2006: to help Louisiana rebuild in the aftermath of Hurricane Katrina.

First NBC falsely projected the value of future tax credits, subsequently forcing the bank to write down their value. Regulators ordered the bank to raise capital, but instead they had to set aside $86 million over the last three months to cover increasing loan losses.

The rebuilding of New Orleans left out affordable and safe housing for the people of New Orleans. Many began gutting and repairing their homes in the lowest lying areas of the city–while any comprehensive plan to rebuild the city was lacking.

First NBC Bank had no interest in rebuilding the mostly Black Lower 9th Ward, home to more than 14,000 before the levees broke in 2005, crushing most of the neighborhood’s homes. Today, the Lower 9th Ward has about 3,000 residents.

The usual role of banks and the developers who get loans from them is for them to make profit–not see that development happens in the interest of the people.

Katrina resulted in the displacement of 400,000 New Orleans residents. Those with the fewest resources ended up in Dallas and Houston (about 40 percent of the displaced) and other parts of Louisiana, in particular Baton Rouge (about 12 percent).

Interestingly, several noted Louisiana State University researchers had warned for years that the development in the floodplains in the Florida Parishes would certainly result in a catastrophe which was seen in Baton Rouge in 2016 when Baton Rouge and surrounding towns suffered the Great Flood displacing over 100,000 people. No banks stepped in to see that development took a course to avoid such catastrophes.

Interest rates are rising, a usual sign of an approaching recession and possibly a larger capitalist crisis. It should come as no surprise that the house of cards of the capitalist system begins to fall in a state with such explicit racism, the greatest percentage of incarcerated people of anywhere in the world and rampant capitalist profit seeking ignoring the environment and needs of the people.